Residential Care Financials

Refundable Accommodation Deposit Interest Rate (MPIR)

What is a RAD, DAP and MPIR?

When you begin researching residential aged care, you will learn about three acronyms relating to the price of residential aged care; they are essential to understand.

- The Refundable Accommodation Deposit (RAD), is a standard room price set by the aged care facility.

- The Daily Accommodation Payment (DAP) is the RAD equivalent paid periodically.

- The Maximum Permissible Interest Rate (MPIR) is the current interest rate used to calculate DAP on a specific RAD value.

The RAD and DAP is determined on the quality, location and features of the accommodation and can vary from bed to bed.

If a facility wants to charge more than $550,000 for their RAD, they need to seek approval from the Aged Care Pricing Commissioner.

The DAP is calculated by multiplying the determined RAD by the current government interest rate (MPIR) and divided by the number of days in that year.

Aged Care Providers must display their accommodation prices in both RAD and DAP figures prior to charging their clients.

From the day of entering care, the new resident has 28 days to work out whether they want to pay the facility a lump sum, daily payment or some combination of the two.

Under the Living Longer, Living Better reforms, the resident must be left with a minimum asset value of 2.25 times the basic age pension at the time of entry.

That sum is subject to quarterly change, but currently it means a resident must be left with at least $58,500 if they choose to pay at least part of the accommodation costs by refundable deposit.

The introduction of the RAD and DAP was predicted to increase marketplace competition and broaden consumer choice.

Alongside the introduction of the RAD and DAP, a means test measuring a combination of assets and income determines how much the government will contribute to a person’s accommodation.

A person’s home is considered a part of their assets, unless a spouse or dependant relative still lives there.

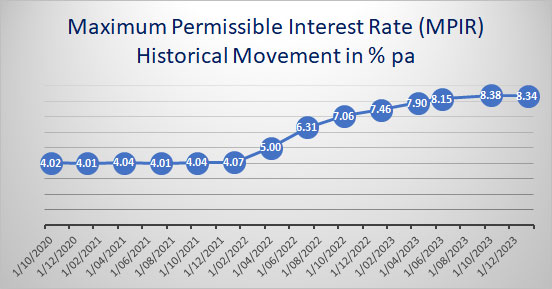

Maximum Permissible Interest Rate (MPIR) - Historical Rates

| Period | MPIR |

|---|---|

| 1/07/2024 to 30/09/2024 | 8.36% |

| 1/04/2024 to 30/06/2024 | 8.34% |

| 1/01/2024 to 31/03/2024 | 8.38% |

| 1/10/2023 to 31/12/2023 | 8.15% |

| 1/07/2023 to 30/09/2023 | 7.90% |

| 1/04/2023 to 30/06/2023 | 7.46% |

| 1/01/2023 to 31/03/2023 | 7.06% |

| 1/10/2022 to 31/12/2022 | 6.31% |

| 1/07/2022 to 30/09/2022 | 5.00% |

| 1/04/2022 to 30/06/2022 | 4.07% |

| 1/01/2022 to 31/03/2022 | 4.04% |

| 1/10/2021 to 31/12/2021 | 4.01% |

| 1/07/2021 to 30/09/2021 | 4.04% |

| 1/04/2021 to 30/06/2021 | 4.01% |

| 1/01/2021 to 31/03/2021 | 4.02% |

Simple RAD to DAP Conversion

Select RAD Amount: $

| % |

Lump Sum of RAD Paid : $

DAP :$20.20 pd

Interest rate (MPIR) is: 8.36%pa

(effective 1/07/2024)